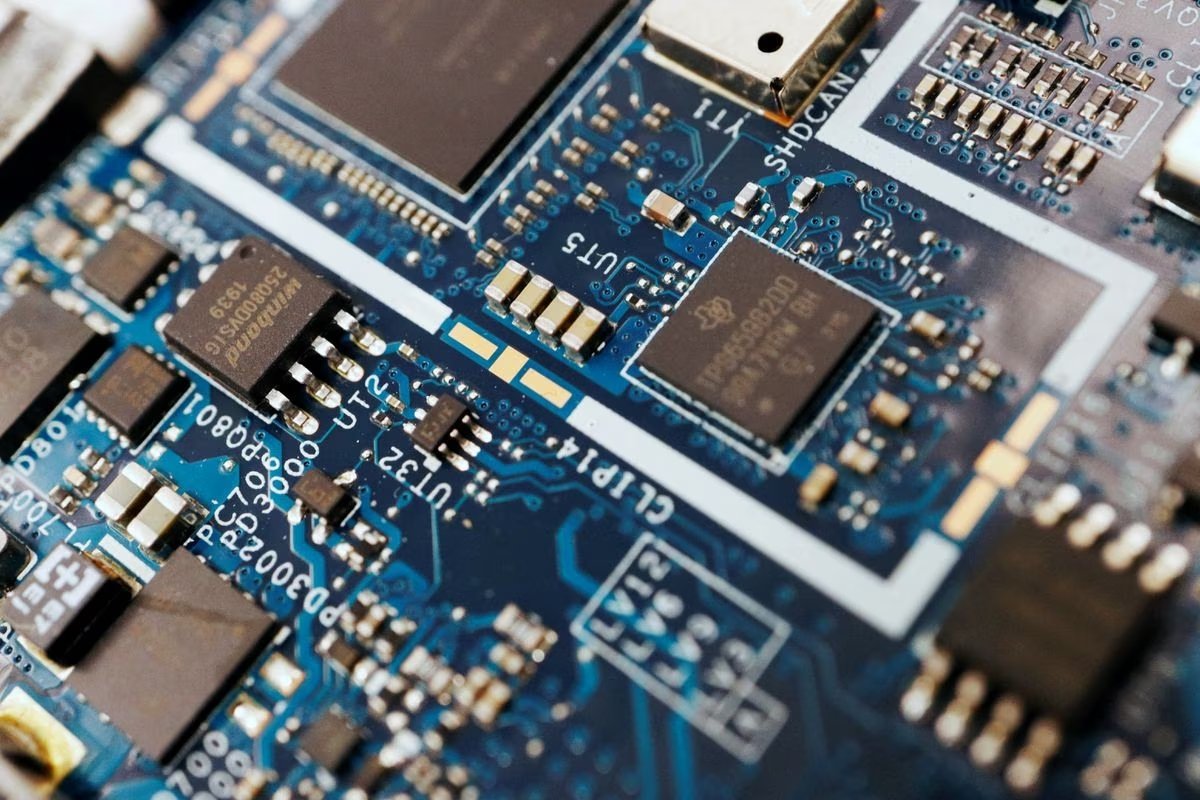

Japan And Netherland To Join Hand With US For China Chip Control

Japan and Netherlands decided on Friday to impose stricter limitations on the sale of chip manufacturing technology to Chinese businesses as a result of years of pressure from Washington. Bloomberg, the Financial Times, and The New York Times all reported on the accord.

The curbs follow the Biden administration’s announcement of such limitations in October 2022 and are intended to hinder China’s capacity to increase its own domestic semiconductor manufacture. There is concern that China may be able to strengthen its military and artificial intelligence capabilities due to increased access to modern semiconductors.

There are no plans to make the deal public, and according to Bloomberg, it might take “months” for Japan and the Netherlands to “finalize legal preparations.”

When questioned about the agreement, Dutch Prime Minister Mark Rutte responded, “This is such a delicate matter that the Dutch government chooses to communicate meticulously, and that implies that we only discuss in a very restricted fashion.”

The most important firm impacted by the limitations in the Netherlands is ASML. It is the only business in the world that makes “ultraviolet lithography” equipment, which is essential for making cutting-edge semiconductors. According to an earlier CNBC story, the business was still able to export older deep ultraviolet lithography (DUV) machines to China but was already unable to send its more sophisticated extreme ultraviolet lithography (EUV) gear.

According to Bloomberg, the new limits are anticipated to ban the sale of “at least some” of these DUV machines, which would further constrain the capacity of Chinese businesses to develop cutting-edge chips and set up manufacturing lines. Around 15% of ASML’s revenues in 2022 will come from China, according to ASML CEO Peter Wennink’s prior comments to CNBC.

The limitations are anticipated to have an effect on Japanese businesses including Tokyo Electron and Nikon.

In addition to stopping shipments to China, the White House has exercised its clout to increase local chip manufacture. The $280 billion CHIPS and Science Act, which contains $52 billion in subsidies for the semiconductor industry, was signed by President Joe Biden last August. New semiconductor manufacturing facilities are being actively built in the US by Intel, TSMC, and Samsung.

Are you excited about the China Chip Control? Comment down below

Also, see

Adani Power Shares Fall For 15% In The Last Three Sessions

Follow us on Instagram – here